Helium 10 vs. Jungle Scout Accuracy: Amazon Sales Data

Table of Contents

Who has the most accurate amazon sales estimates?

Helium 10? Jungle Scout? Amazon?

Why are accurate sales estimates crucial for Amazon Product Research?

Why is having accurate sales estimates important when doing product and competitor research on Amazon? If the top products in a niche you are analyzing are all selling 500 products a month each, you would make a different decision about entering that niche compared to if the top products in a niche are selling 50 products a month.

When tracking the market share of your competitors vs. your products, you need to have confidence in the sales estimates you are looking at to be able to see who is gaining or losing ground.

Methods of Estimating Sales on Amazon

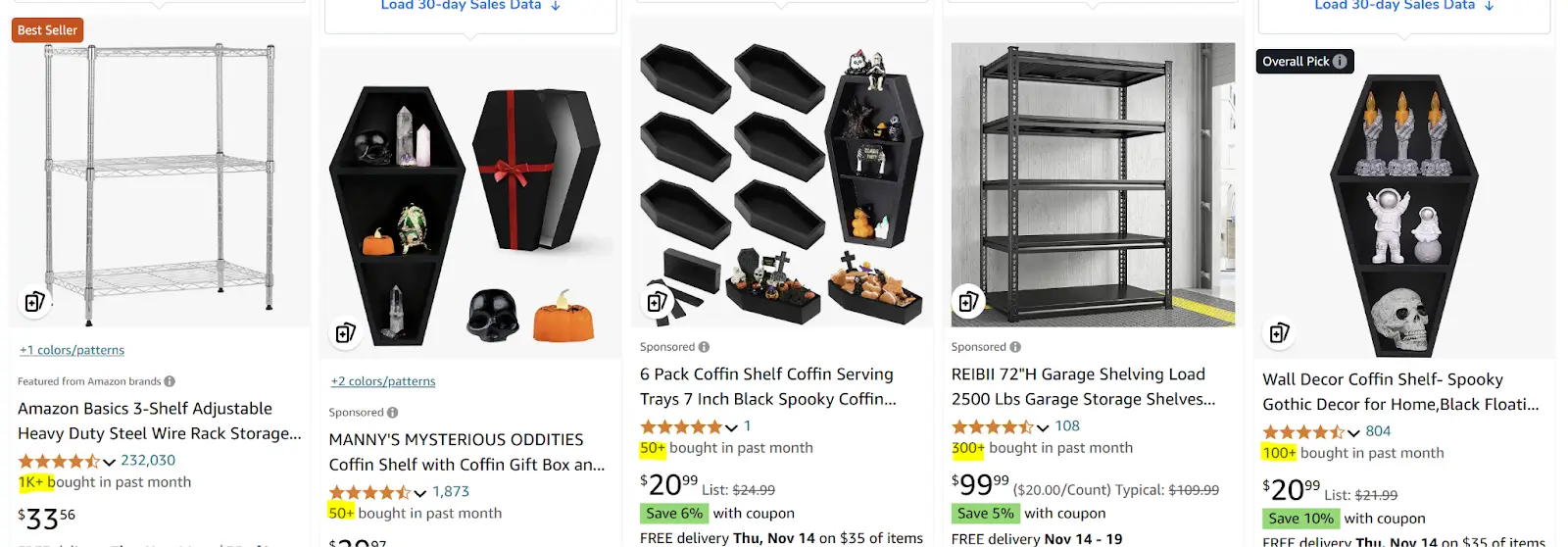

Today we will break down the top three most used ways of estimating sales on Amazon. Using the Amazon “bought in the past month” metric, using Jungle Scout, and using Helium 10.

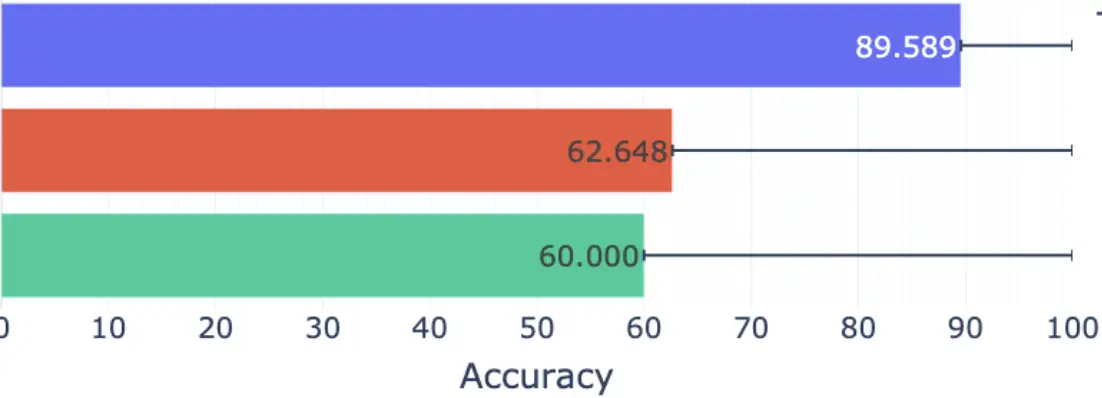

Spoiler alert, after a detailed case study of 29,906 active Amazon products across 32 different categories, Helium 10 has come out on top with 89.59% accuracy while Jungle Scout only had 60.00% accuracy. The Amazon “bought in the past month” metric was missing too many products for estimates, and also due to its very limited number of estimates (It can only show estimates of 50+, 100+, 200+, 300+, 500+, 1000+, etc), its accuracy could not even come close to Helium 10 and Jungle Scout.

There are over 1,000,000 active users of Helium 10 Sales estimates, while those who use Jungle Scout sales estimates (including a few thousand Data Dive (based on Jungle Scout numbers) users) is only a little over 400,000. Today we will find out why those million Helium 10 users have made the right decision with which numbers to trust.

We will first go over the detailed case study of the nearly 30,000 Amazon products, and then I will break down a live estimate check on active products that I have access to seller central on, that I did during the video you see at the top of this page.

Warning: This detailed case study will get pretty deep into the weeds with formulas and terminology that data scientists use. A lot of it I had to google what the heck some of these terms mean, but I’ll try to break things down as much as I can to make it understandable to the common folk like me!

First of all, let me just say, that the 89.59% vs. 60.00% accuracy difference is EXTREMELY generous to Jungle Scout. Why? One reason is that we had to give an big benefit when calculating. Of the ASINs that were selected, a whopping 59% of them did NOT have a Jungle Scout Estimate at all! Instead of marking those as 0 sales and thus showing Jungle Scout to be even more inaccurate than it already is, we went ahead and excluded those products from the results, even though Helium 10 did have estimates on the majority of them.

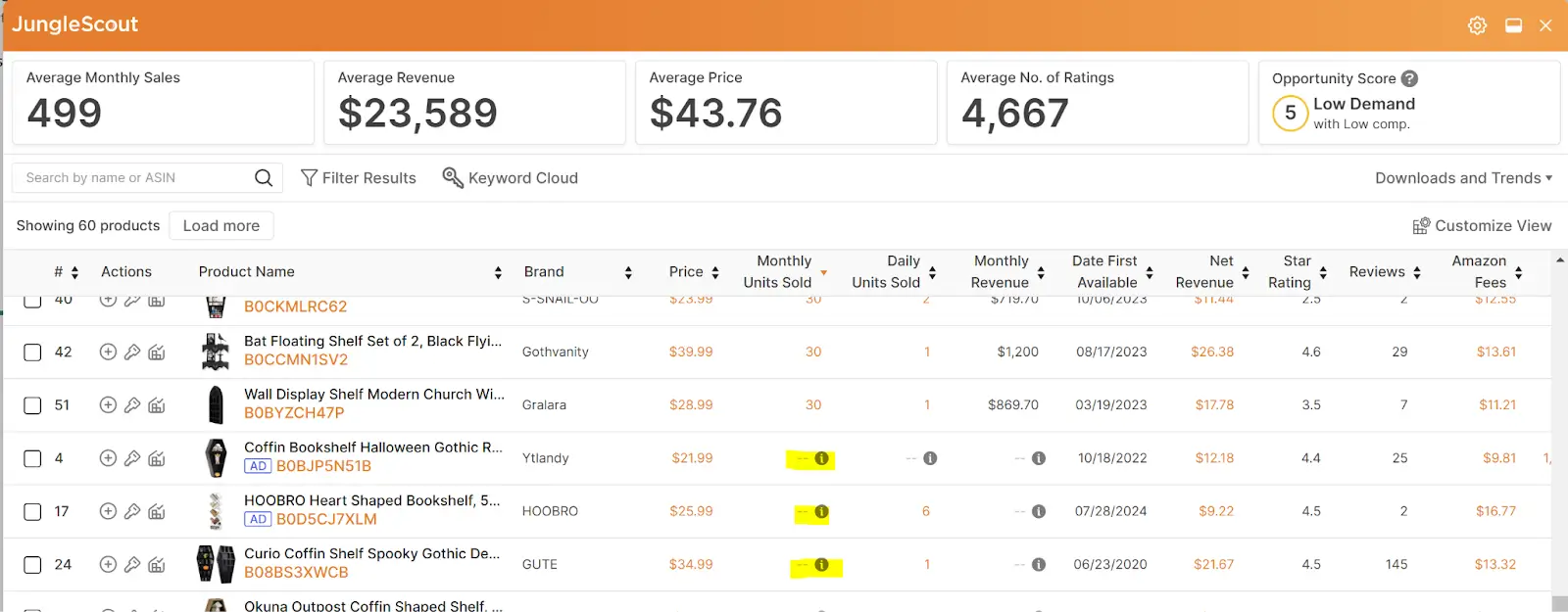

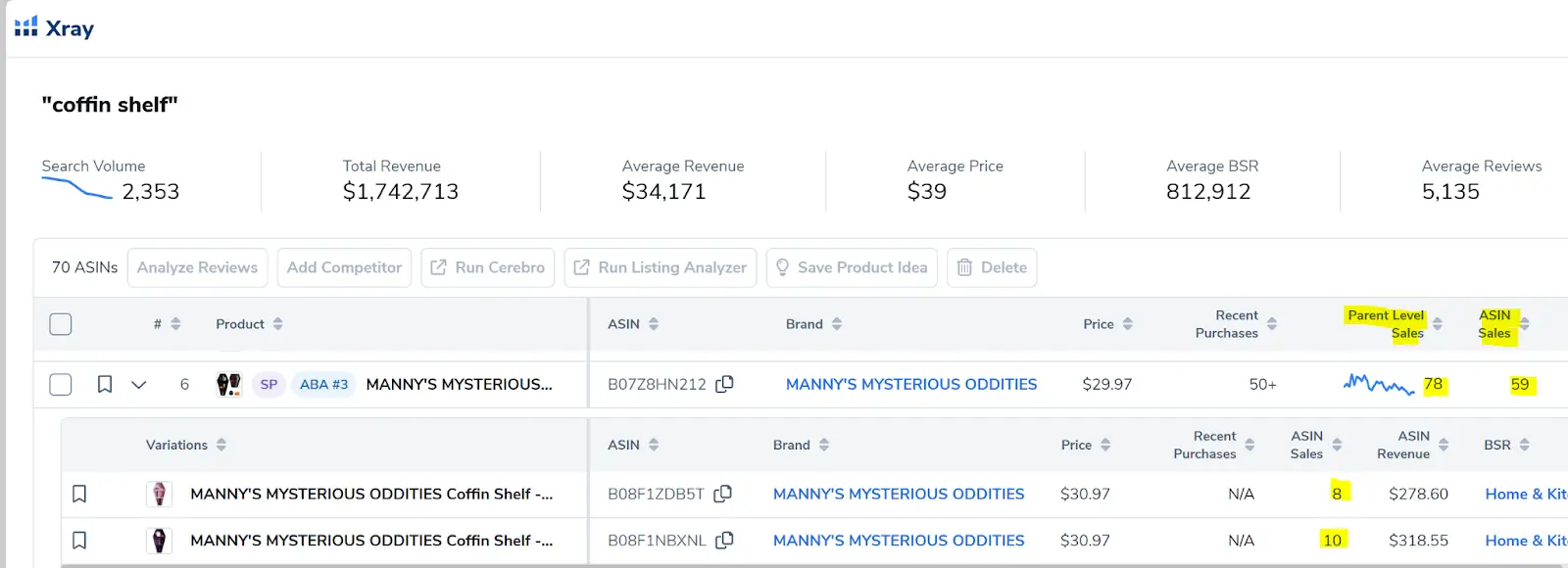

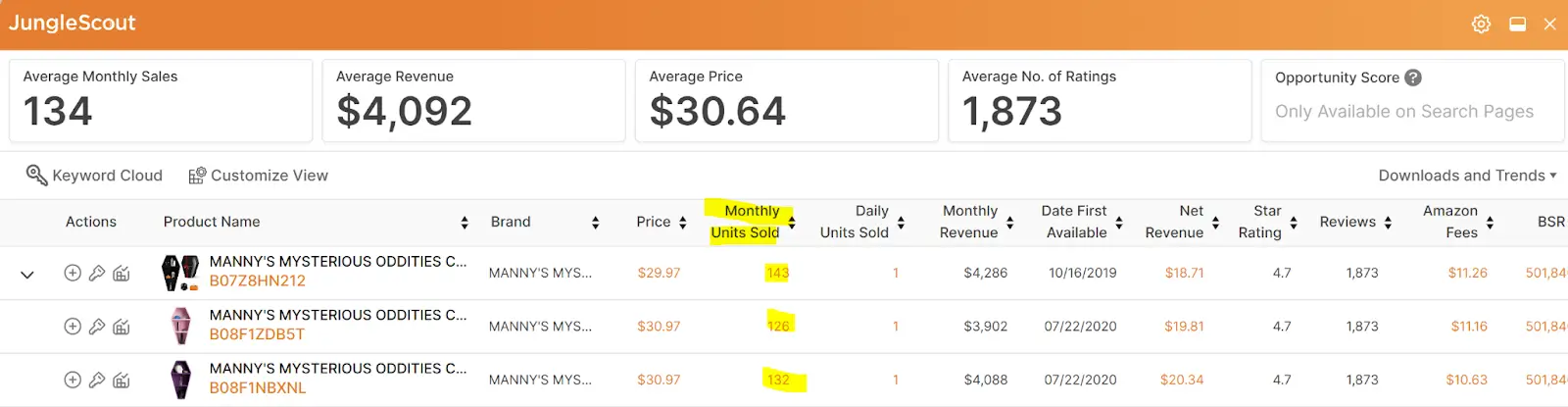

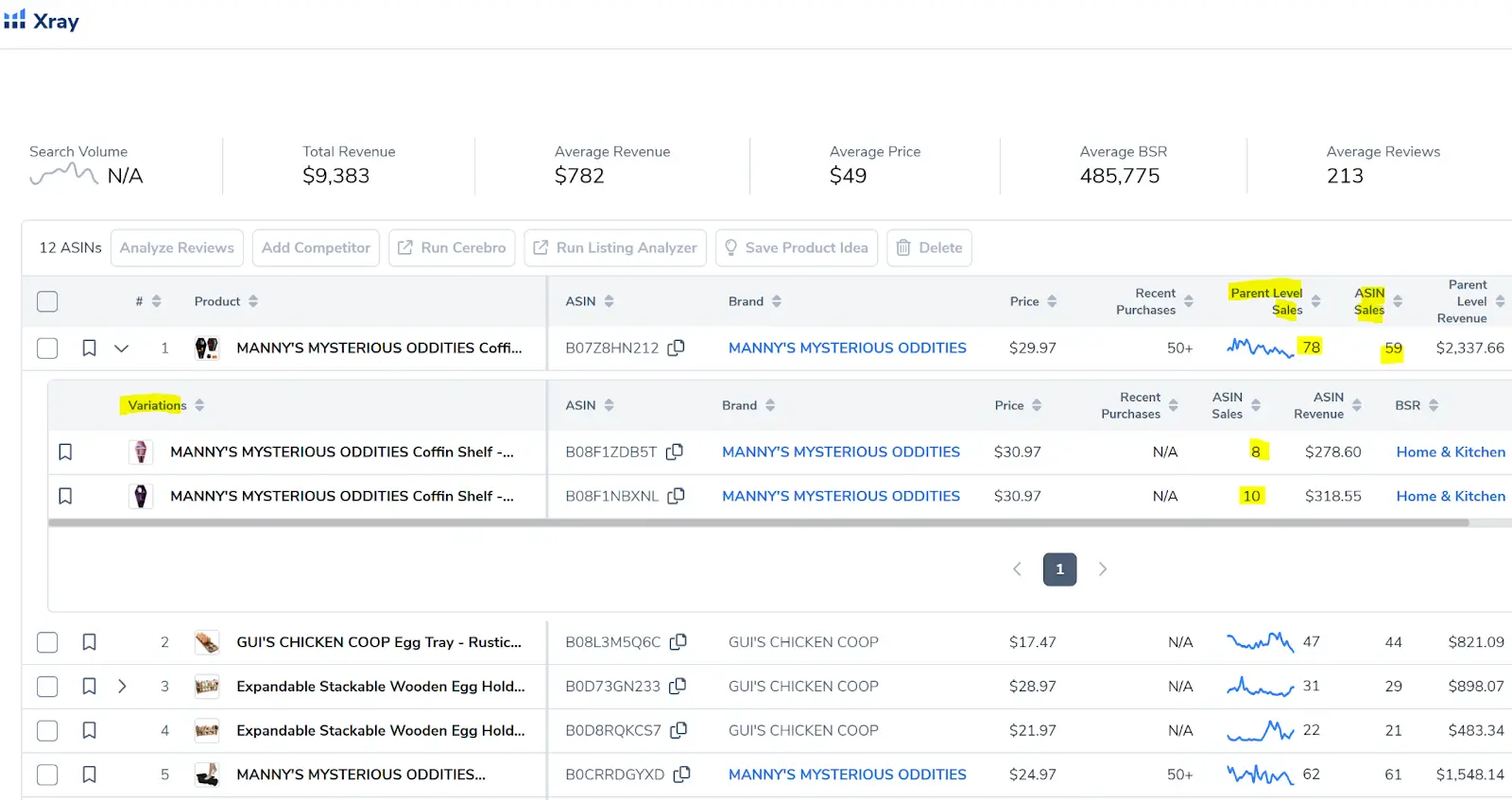

Another thing that would have made the accuracy difference way more than 89.59% to 60.00%, is the fact that in 2024, Helium 10 Xray added sales estimates at the child ASIN level. This means that if a product has a black, red, blue, etc. option, Helium 10 gives estimates to all of those products individually. Jungle Scout (and Helium 10 in the past), only gives sales estimates at the parent level…meaning the same number shows for all child items that represents all child item sales put together.

As you can see above, there are estimates at the child level in Helium 10. In Jungle Scout, it looks like there is an error on this particular one since they surely are not saying something that only has less than 10 sales a month has 126….normally on Jungle Scout, the sales estimate for all colors is the same.

So to give Jungle Scout a chance to be closer to Helium 10’s numbers, we went ahead and only showed estimates at the Parent level. Had we not done these things, Jungle Scout accuracy would have dipped to below 20%

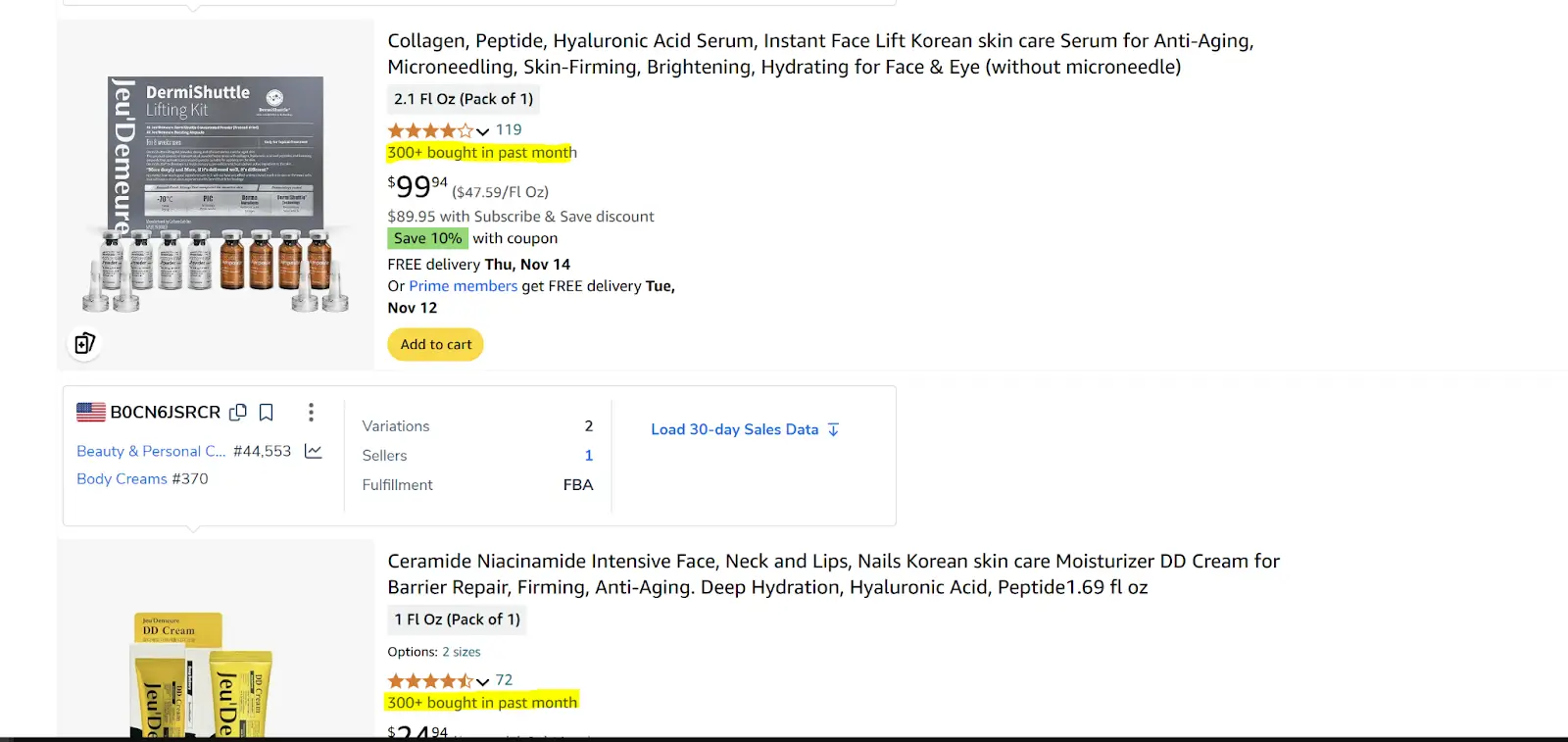

What did I mean when I said the Amazon “bought in past month” metric was too far off to compare? Well, first of all, its not showing the number of units sold which is what we are talking about. It is an estimate of the number of customers who purchased that product in the last 30 days.

In addition, for some strange reason it just isn’t always accurate when compared to actual sales. Lastly, due to only the possibility of a few numbers to show up (50, 100, 200, etc.), by definition a big portion of products will have actual sales that are percentage-wise, very different than the bought in the past month metric.

For example, it does not give ANY estimates on any product less than 50. Additionally, lets say a product has the “500+ bought in last month” sticker. This covers products that have sold 500 units all the way to double that amount, 1000 units. So many products are up to 100% off of actual sales.

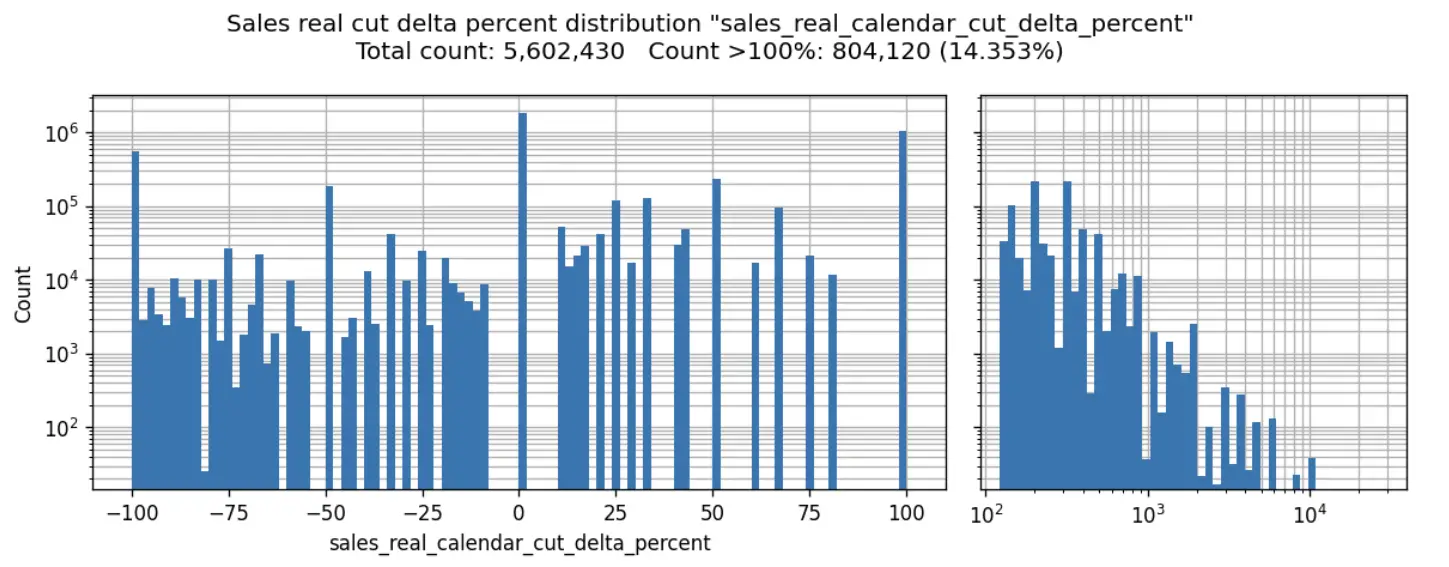

I am not going to go too in depth to the study on this but the chart below shows what our data science team found after analyzing MILLIONS of products and comparing it to the bought in the last month metric…..you can see how many were up to 100% off or more.

One last thing: The Jungle Scout case study that is often quoted by them where they claim a higher accuracy rate than Helium 10 is from 2019. Obviously both Jungle Scout and Helium 10 works on their sales estimate algorithms constantly to maintain accuracy. I do not want there to be any accusations though of Helium 10 trying to make some new accurate number JUST for this study, in order to beat Jungle Scout.

Instead of just comparing the CURRENT Jungle Scout and Helium 10 estimates, I had the team dust off our OLD sales estimate model from all the way back in 2019….the exact one that we used way back then, completely untouched in the last 5 years. Why? My hopes were that we can show that even Helium 10’s OLD algorithm is STILL more accurate then Jungle Scout’s current one. Was it? Keep on reading to find out!

Case Study Results: The Most Accurate Tool

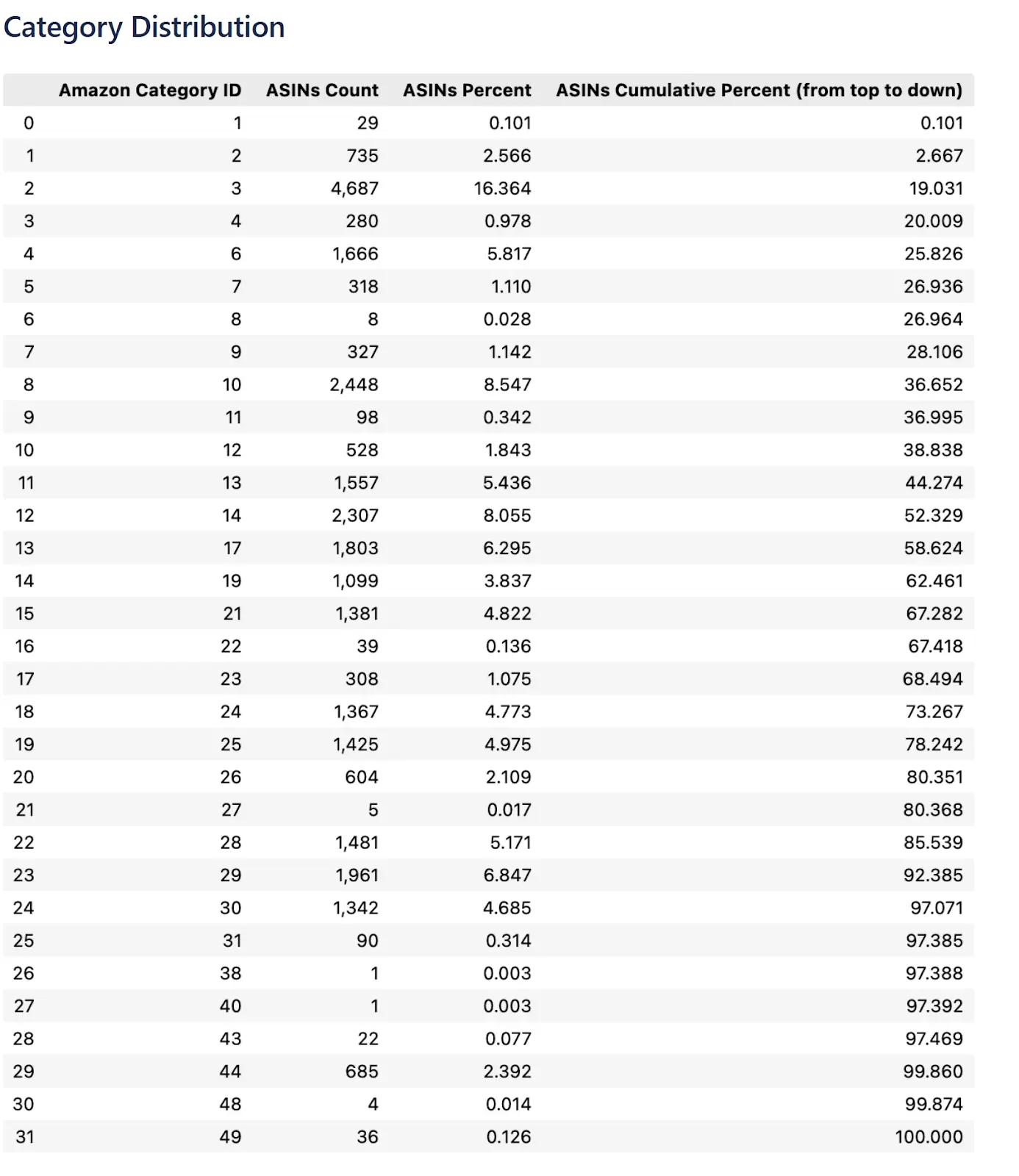

Let me set the playing field for this case study. The data set comprises 29,906 Amazon products collected for July 2024 – weeks from 2024-06-30 to 2024-08-03. True sales data was known for all products, and these were compared to numbers from Helium 10 XRay and Jungle Scout current estimates, as well as the 2019 version of Helium 10’s sales estimation model.

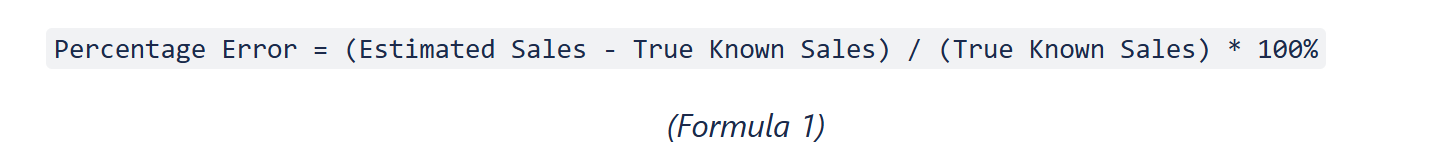

We wanted to use the same method of calculation as Jungle Scout’s previous “case studies”, so the primary metric used for comparison was the Percentage Error, calculated using the formula:

Additionally, the Median Absolute Percentage Error (MAPE) was computed as:

Median Absolute Percentage Error = Median(Absolute(Percentage Error))

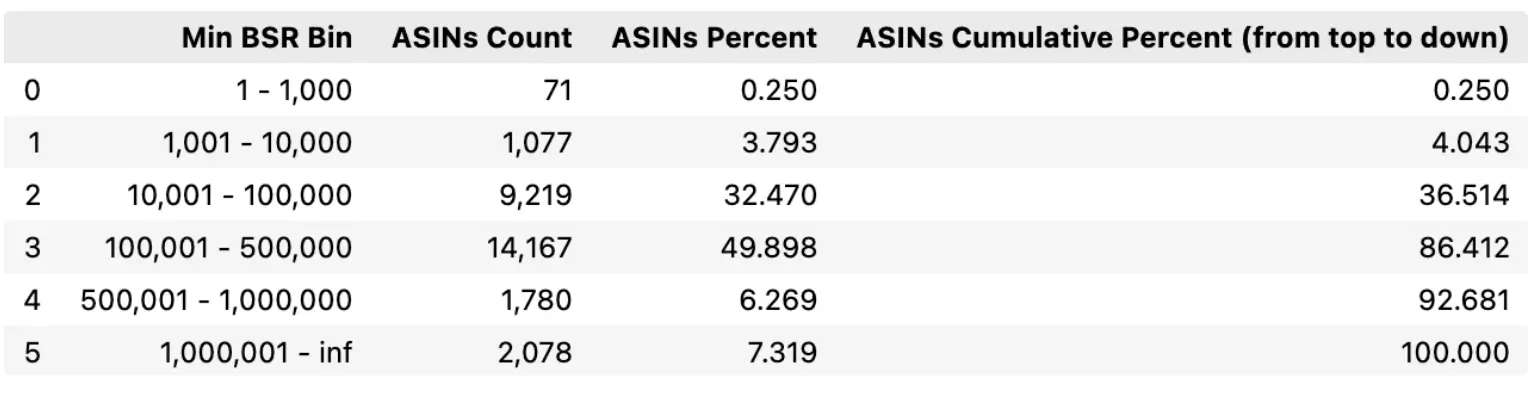

To make sure that this study was an accurate representation of….well…. “Accuracy,” we chose ASINs across a broad range of both Amazon BSR and Amazon categories ad you can see below.

The first check was taking the median difference in estimated sales relative to actual sales. In other words, an estimate that is 25% under, has the same difference as an estimate that is 25% over. In this exercise, the closest to 100% means it is the most accurate.

Blue is the current Helium 10 estimation. Red is the 2019 Helium 10 estimation. Green is the current Jungle Scout Estimation.

Helium 10 absolutely crushes the accuracy test 89.59% to 60.00% for Jungle Scout! But perhaps even more noteworthy is the fact that even the 2019 Helium 10 estimation model is more accurate than current Jungle Scout by 2.65%!

There are other ways to break the data down. Namely looking at something called the Median Absolute Percentage Error, by viewing a Box plot. What in the heck is a box plot? Here is the definition straight from Wikipedia:

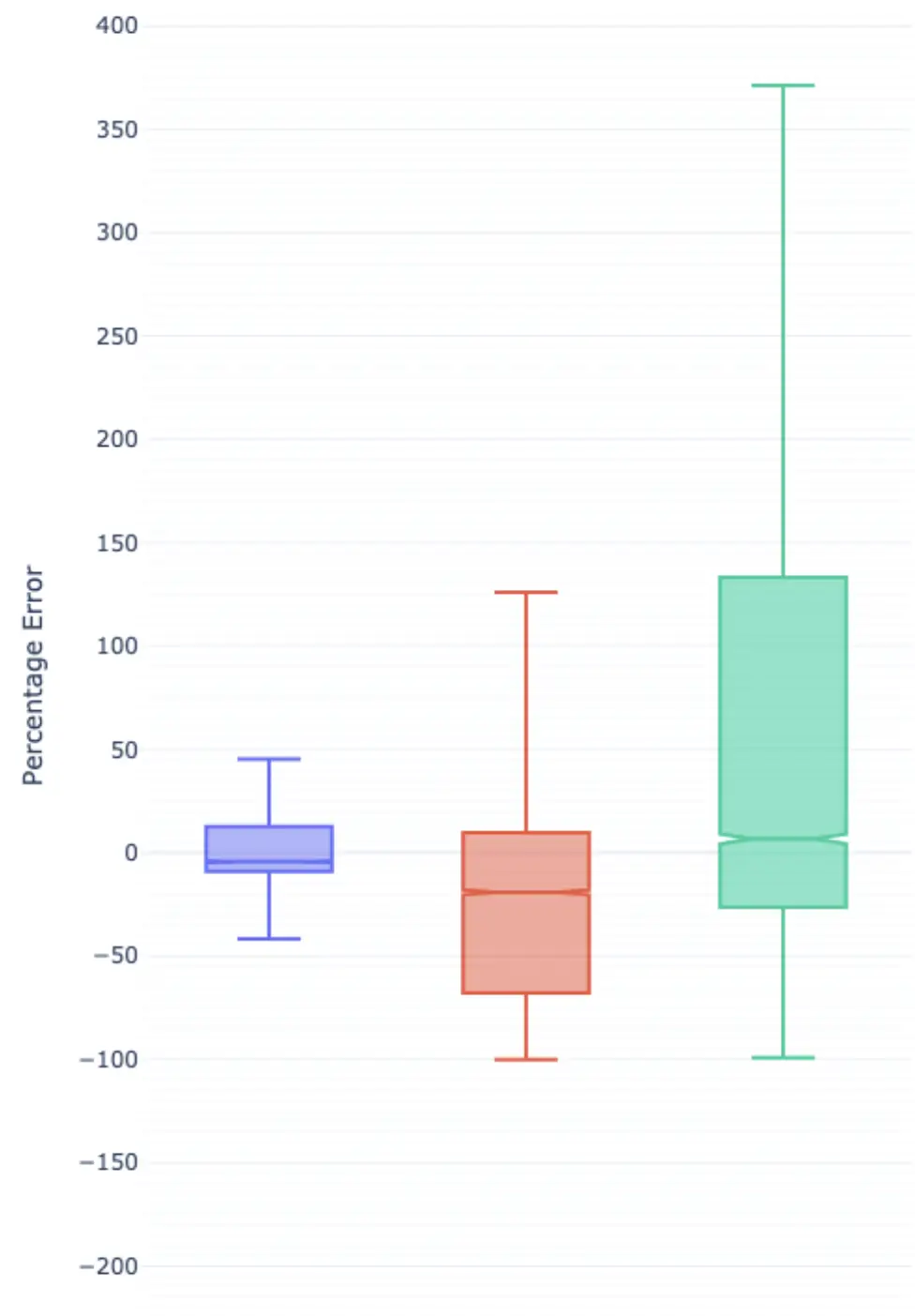

In language that is easier to understand, the smaller the box below, that means that is more accurate. In addition, the shorter those “whiskers” or T shaped lines, the more accurate. Lets take a look at how the graph came out.

Once again, the most accurate is the blue Helium 10 current model. In second place yet again is the 2019 Helium 10 model. Last but not least, you can see how the green Jungle Scout model ended up.

For those who understand how these kind of charts work, here are some more details: Helium 10 had narrow error distribution, with 50% of interquartile data between -9% and 13%. Jungle Scout had the most extensive range of errors, with 50% of interquartile data between -26% and 133%.

The learning is that no matter how you calculate it, Helium 10 is much more accurate than Jungle Scout, and always has been. Its not just about sales estimates, but also search volume estimates as well.

Now, if you have been following my podcasts and blogs for a while, you probably have heard me “make fun of” the Jungle Scout case studies about sales estimations…saying how silly it is to try to make a big deal out of supposedly being (according to their erroneous data) 10% more accurate than Helium 10. (actually if you look at their own graph, they don’t even calculate the percentage correctly! 84-74 is not 14!!)

The reason why to me, making a big deal out of something like this, was so silly is that even if you believed those numbers, would a 10% difference in accuracy have you make a different decision? Probably almost never.

If you were looking at sales estimates in a niche you were investigating, and lets say the real sales estimate average of the top products was 100/month. But tool A said it was 84, and tool B said it was 74. If you only saw the number 84, would your decision have been different compared to seeing the number 74? Probably not!

However, as you can see, even when giving Jungle Scout the benefit of the doubt, and taking out all of their ASINs that they are missing estimates for, and taking out all of the child ASINs they do not have estimates for, they still are 30% less accurate than Helium 10, meaning many more situations where they are so far off, that you WOULD actually make different decisions, if you had the more accurate data.

In addition, I would imagine anyone seeing a case study made by the company who it covers, might take it with a grain of salt, thinking that whoever is doing the case study, they would want to show data that paints that company in a good light. That’s why I like also doing “live” case studies where I pull products on the fly so that people can see the data is not manipulated. So I am following up the above case study with the below results from a live data pull that you can watch the video of.

Check out the above video and you’ll be able to see a live recording where you can watch the clock on my computer so that you know I did not edit anything or manipulate the data in any way.

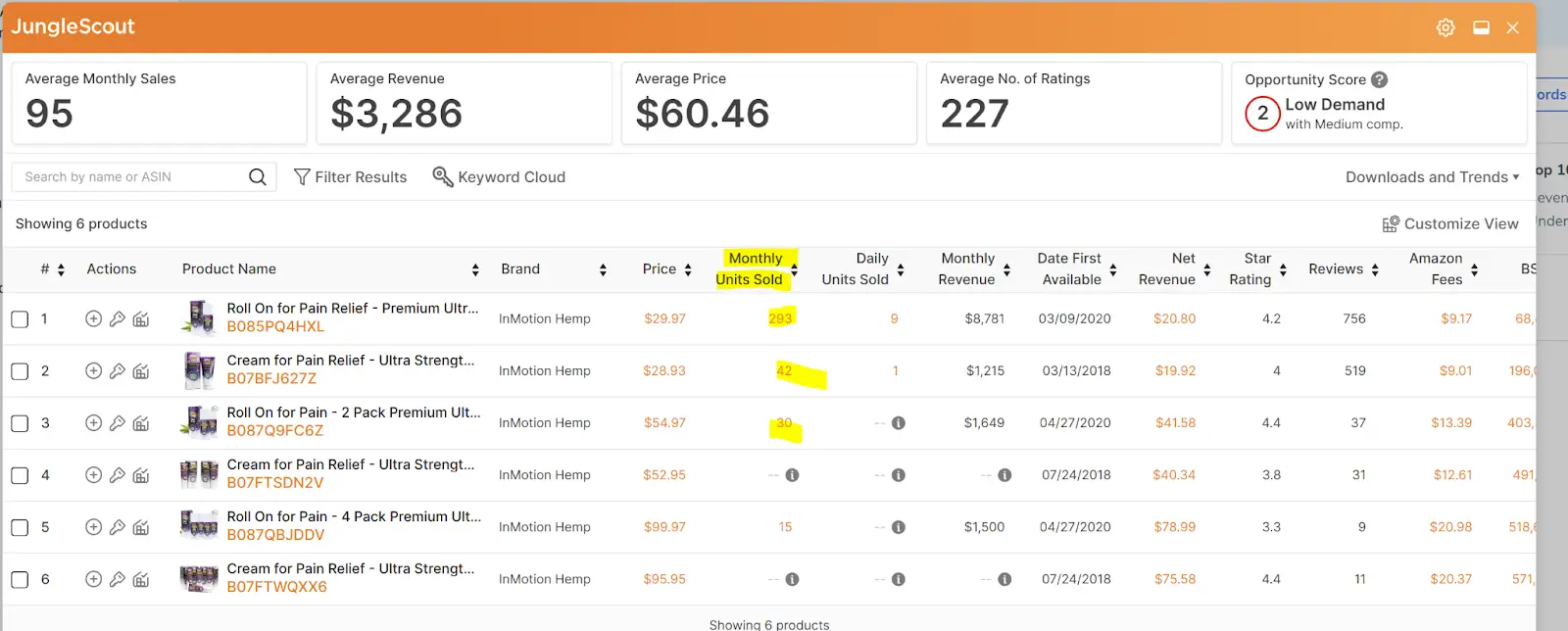

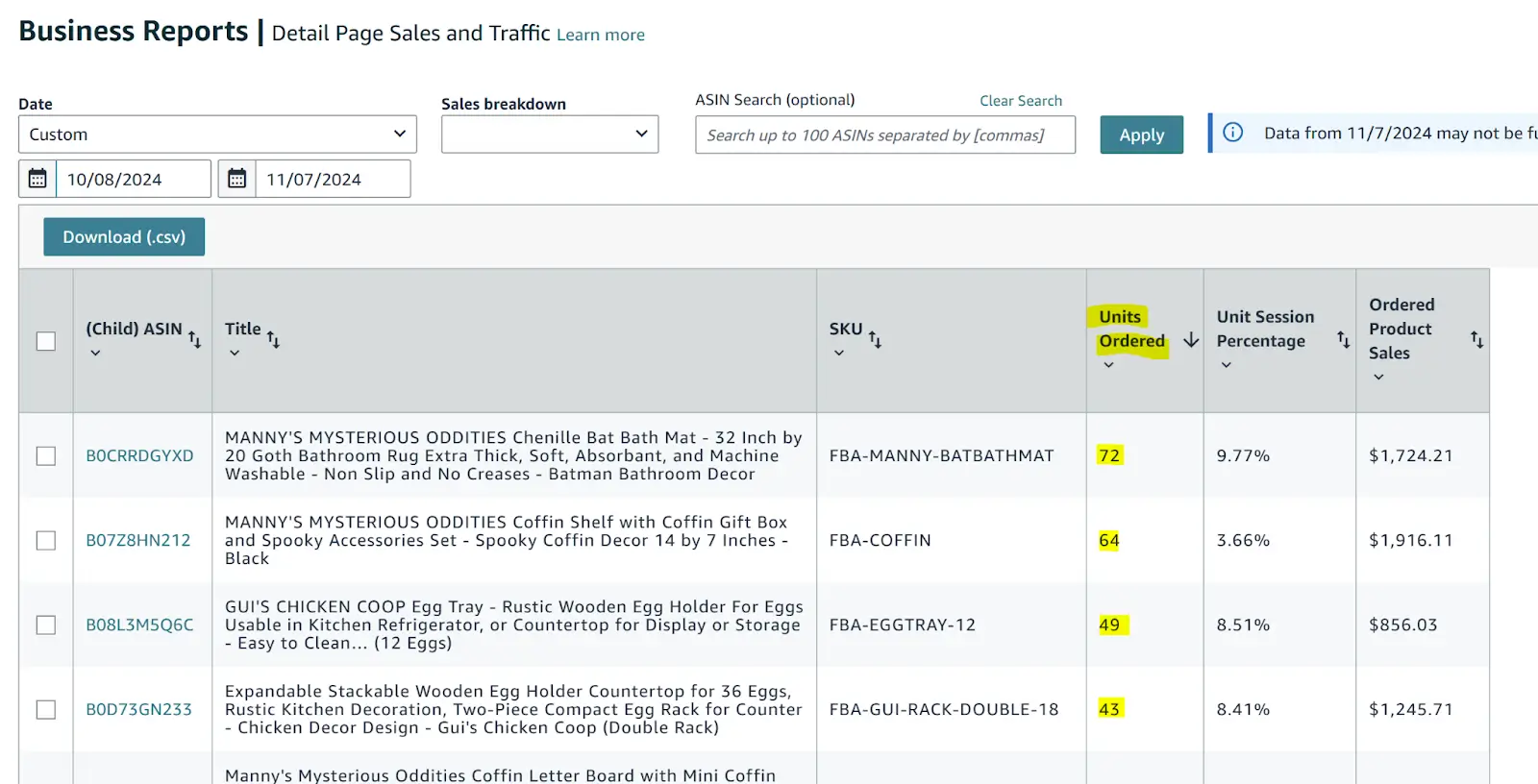

What I did in the live case study, is go to 3 different Amazon accounts, I have actual sales data from: Project X, Cellto, and Inmotion Hemp.

I then went in and captured the Helium 10 Sales estimates, including those at the parent and child ASIN level.

I then captured if Amazon had a “bought in the last month” metric.

Next, I captured the Jungle Scout estimate which is only at the parent level.

Lastly, I took the data from Seller Central Business Reports or Profits to see the REAL sales in the last 30 days.

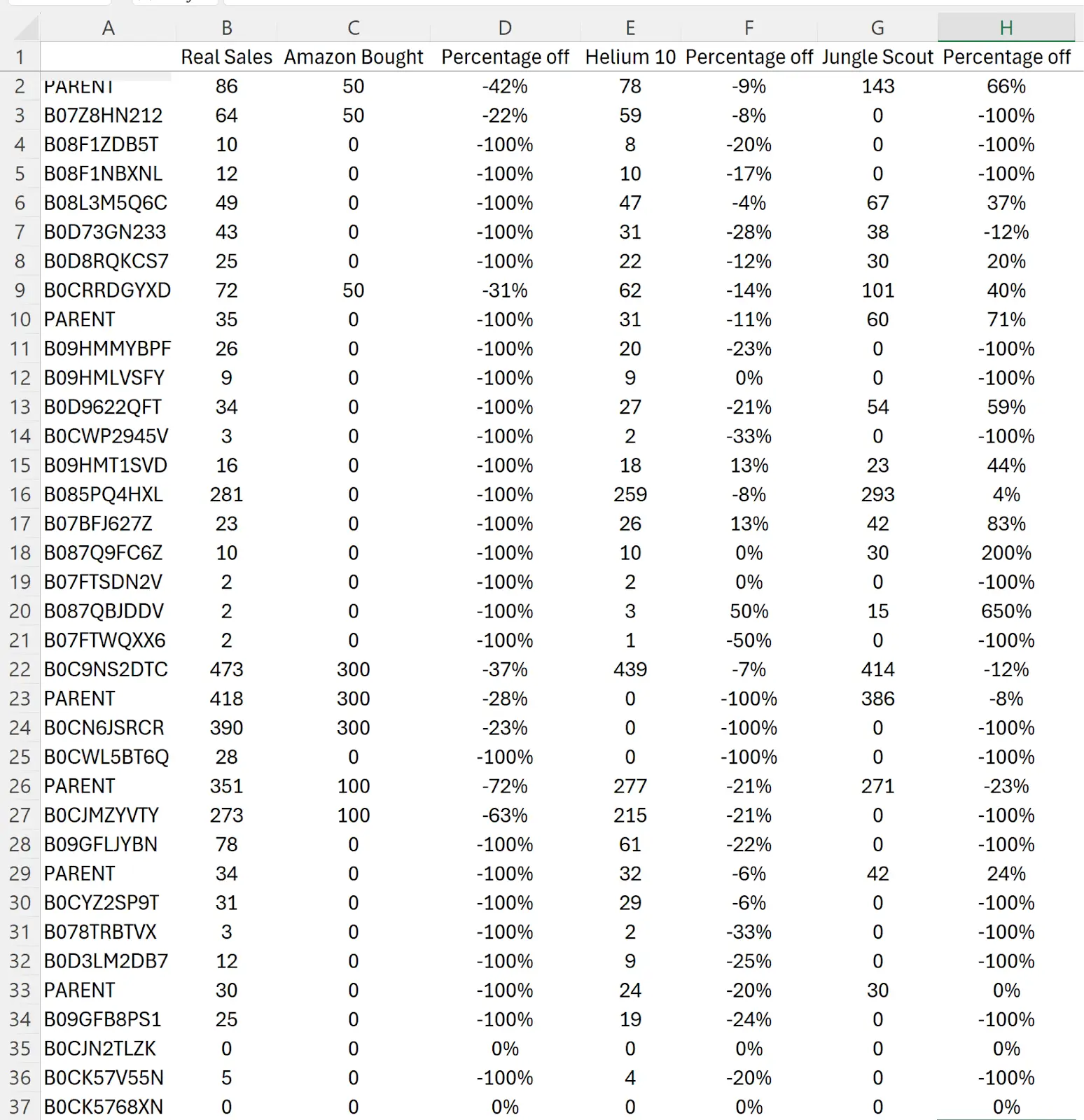

I added all of these to an Excel spreadsheet so I could track how far off the three estimates were to the real data.

Lets see what the takeaways are:

- The Amazon bought metric only had 5 estimates out of 37 ASINs

- Helium 10 had 34 out of 37 estimates, including child items

- Jungle Scout had 21 out of 37 estimates

- Amazon bought metric was the most accurate for 1 out of 37 ASINs

- Jungle Scout was the most accurate for 4 out of 37 ASINs

- Helium 10 was the most accurate for 28 out of 37 ASINs

- On actual estimates, Amazon bought was at most, 72% off.

- On actual estimates, Jungle Scout was at most 650% off.

- On actual estimates, Helium 10 was at most 50% off

No matter which way you slice it, the clear winner in Amazon sales estimate accuracy is Helium 10. So what are you waiting for? Make sure to sign up for a Helium 10 account today and start benefiting from the most accurate sales estimates in the world!

Sign up today and start taking advantage of the world’s most accurate product research tool for Amazon sellers!

Achieve More Results in Less Time

Accelerate the Growth of Your Business, Brand or Agency

Maximize your results and drive success faster with Helium 10’s full suite of Amazon and Walmart solutions.